Malaysia business and financial market news. Over the past few years the income tax department of India has digitized the entire Income Tax Collection and return filing process.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

As a result it has become very convenient for individuals and businesses to pay their taxes online file returns and finally track their payments history through the various Income Tax.

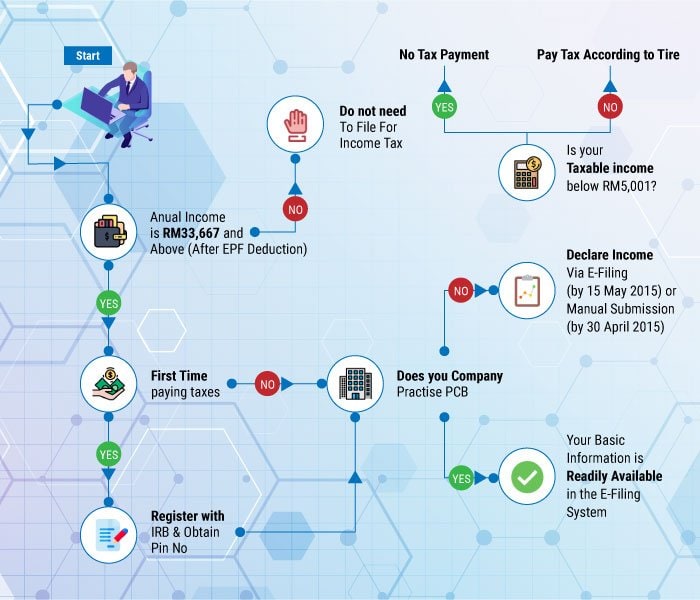

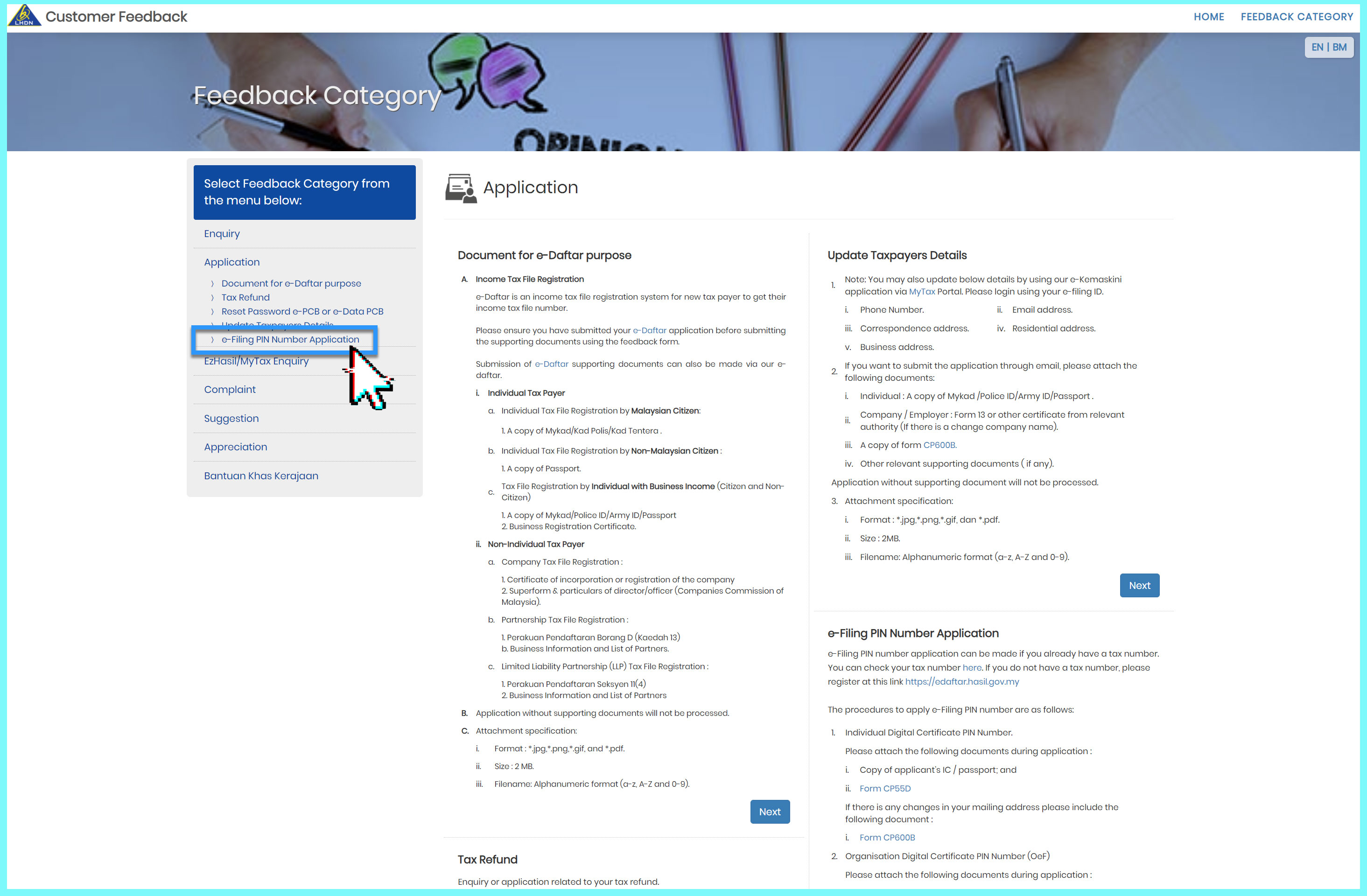

. Understand if you are liable to file the return. Then click on e-Filing PIN Number Application. List your total income expenses and depreciation for each rental property on the appropriate line of Schedule E.

Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions. Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation. Filing your tax through e-Filing also gives you more time to file your taxes as opposed to the traditional method of filing where the deadline is usually on April 30.

Refund Transfer is a bank deposit product not a loan. The loan is secured on the borrowers property through a process. Form E Form used by company to declare employees status and their salary details to LHDN Deadline.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Payments you authorize from the account associated with your Refund Transfer will reduce the net proceeds of your refund sent to you. The bill of the Correction and Rehabilitation Centres was preceded by a proposal of updates from the Mission that led to several meetings during which the Mission together with the PCP was sitting in an ad.

Know who should file income tax returns for FY 2021-22. Calculate your taxable salary Taxable Salary Gross Salary EPF. Income tax PCB calculation.

Content Writer 247 Our private AI. Both tools are available in English and Spanish and track the status of amended returns for the current year and up to. Find your PCB amount in this Income tax PCB 2009 Chart.

Personal finance advice from Malaysia and world. You can file your return and receive your refund without applying for a Refund Transfer. Criteria on Incomplete ITRF.

The workshop was opened by HE the Minister of Justice a representative from the Palestinian Civil Police and the acting head of Mission. Form ITR 1 to ITR 7 for filing Income east. 31032022 30042022 for e-filing 4.

Return Form RF Filing Programme. Form BE Income tax return for individual who only received employment income Deadline. Income tax rates are progressive at the federal level and in most of the cantons.

Any payable balance resulting from the annual income tax return must be paid not later than the due date established for filing the return. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. Tool requires no monthly subscription.

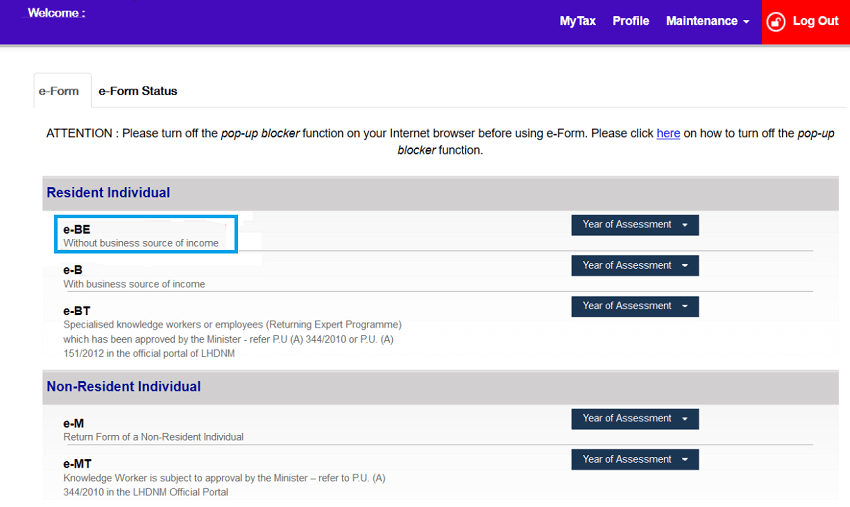

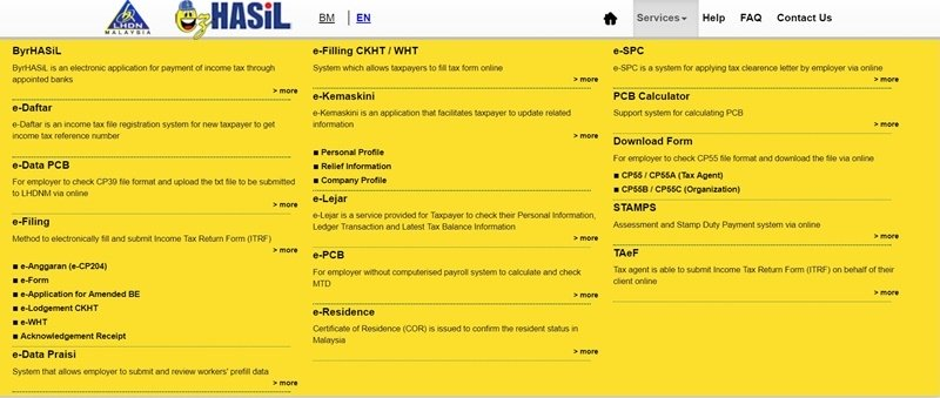

How to fill up e-Filing for first timers. Meanwhile for the B form resident individuals who carry. Visit ezHASiL and go to the website menu Customer Feedback.

You can check the status of your Form 1040-X Amended US. Dialog Minutes For Operational. The SME company means company incorporated in Malaysia with a paid up capital of.

Individual Income Tax Return using the Wheres My Amended Return. These are the steps to fill up e-Filing online through the ezHASiL portal. Download Form CP55D and fill in the required information.

Pengemukaan Borang Nyata BN Tahun Saraan 2021 dan Tahun Taksiran 2021 melalui e-Filing bagi Borang E BE B M BT MT P TF dan TP boleh dilakukan mulai 01 Mac 2022. If this is your first time filing your tax through e-Filing dont worry weve. Type Of Offences Provisions Under ITA 1967 Amount Of Fine RM Fail to furnish an Income Tax Return Form.

The Star Online delivers economic news stock share prices. 1121 200 to 2000 or imprisonment or both. If the understatement exceeds the greater of 10 of the tax required to be shown on the return or 5000 10000 for corporations other than S corporations or personal holding companies the penalty applies.

A qualifying expected tax refund and e-filing are required. All income sources are added together and from such total income all applicable deductions are subtracted. Thus his chargeable income after taking the tax deduction for his donation into account is RM60000 RM6000 RM54000 thus lowering the amount of tax he has to pay.

All income is taxed on the basis of the same tax return with generally the same tax rate ie. This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing.

Then scan your IC in PDF format. Over 500000 Words Free. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

Income Tax Department has notified 7 various forms up till now ie. Return Form RF Filing Programme For The Year 2021. If you rent real estate such as buildings rooms or apartments you normally report your rental income and expenses on Form 1040 or 1040-SR Schedule E Part I.

Schedule On Submission Of Return Forms RF Contoh Format Baucar Dividen. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24. Armenia Last reviewed 07 June 2022 20 April.

Online tool or by calling the toll-free telephone number 866-464-2050 three weeks after you file your amended return. Engine as all of the big players - But without the insane monthly fees and word limits. The substantial understatement component of the accuracy-related penalty provides for a dollar criteria.

Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing. 30042022 15052022 for e. Klik pautan berikut untuk maklumat lanjut mengenai Program Memfail Borang Nyata BN bagi Tahun 2022.

My monthly PCB income tax is increased much since march 2009 HR told me that Malaysia monthly income tax PCB deduction rate is changed since year 2009. Instalment payments must be made on a monthly basis beginning in the first month after the due date of filing of the tax returns. Some cantons have recently introduced flat rate taxation.

Offences Fines and Penalties.

7 Tips To File Malaysian Income Tax For Beginners

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

E Filing Beginners Guide Income Tax Malaysia 2022 Youtube

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

Malaysia Personal Income Tax Guide 2020 Ya 2019

How To File Your Taxes For The First Time

9 Income Tax Ideas Income Tax Tax Income

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Ctos Lhdn E Filing Guide For Clueless Employees

Income Tax Filing Malaysia E Filing And Corporate Tax Return

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

Assessing E Government Services The Case Of E Filing Of Personal Income Tax In Malaysia Government Law Book Chapter Igi Global

How To File Income Tax For The First Time

Guide To Using Lhdn E Filing To File Your Income Tax

Mygov Public Service Delivery And Local Government Eservice Delivery G2c Lhdnm E Filing

15 Tax Deductions You Should Know E Filing Guidance Financetwitter